Carbon Offsetting vs. Insetting: What’s the Difference and Why It Matters

As the climate crisis accelerates and pressure grows for organisations to take meaningful action, terms like carbon offsetting and carbon insetting have entered the mainstream. While they sound similar, these approaches to emissions reduction are fundamentally different in execution and impact.

Understanding the difference isn’t just about semantics – it’s about strategy, accountability, and long-term environmental value. This blog aims to define the difference between both terms and provide a bit more insight into what they entail alongside some examples for better visualisation.

What Is Carbon Offsetting?

Carbon offsetting involves compensating for greenhouse gas emissions by investing in external projects that reduce or remove carbon from the atmosphere. These projects are often far removed from the emitter’s own operations.

Common offset projects include:

• Reforestation and forest protection efforts

• Renewable energy projects (like wind or solar farms)

• Methane capture at landfills or livestock farms

• Carbon capture and storage technology

Essentially, a company (or individual) continues to emit carbon, but compensates by “neutralising” those emissions by funding a reduction somewhere else.

Real life example: An airline purchases carbon credits to support a tree-planting initiative in Kenya to offset emissions from its international flights.

What Is Carbon Insetting?

Carbon insetting is about reducing emissions within a company’s own operations or value chain. Rather than paying someone else to lower emissions elsewhere, insetting means making internal or supply chain improvements that cut emissions at the source.

Insetting activities might include:

• Helping suppliers adopt regenerative agriculture practices

• Investing in energy-efficient manufacturing techniques

• Switching to electric delivery fleets or sustainable packaging

• Supporting local ecosystem restoration near a facility

Insetting is typically more complex but tends to have deeper and more lasting impacts, both environmentally and economically.

Real life example: A coffee company works directly with its farmers to improve soil health and reduce fertiliser use, thereby cutting emissions while boosting productivity.

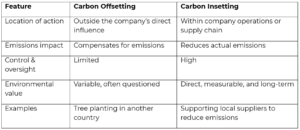

Offsetting vs. Insetting: A Quick Comparison

Why the Difference Matters

Offsetting has faced criticism in recent years, particularly when used as a substitute for real emissions reductions. Questions about the transparency, permanence, and additionality of offset projects have led many experts and watchdog groups to call for a shift in focus; from compensation to transformation.

Insetting, while more involved, aligns more closely with net-zero goals, where companies aim to cut emissions across their operations before relying on offsets as a last resort.

Both approaches can play a role in a responsible climate strategy, but insetting is increasingly seen as best practice as it demonstrates a company’s commitment to systemic change.

A Note for Investor Relations Professionals

For those working in Investor Relations (IR), understanding and clearly communicating the difference between offsetting and insetting is no longer optional – it’s a strategic necessity. As environmental, social, and governance (ESG) considerations become integral to capital allocation decisions, investors are scrutinising how companies address their emissions beyond just carbon accounting.

Why it matters for investors:

• Offsetting can offer quick wins by “neutralising” emissions on paper, but it doesn’t necessarily reduce emissions within the company’s value chain. This can raise concerns around greenwashing, especially if offsets are used in place of real operational improvements.

• Insetting, on the other hand, reflects deeper integration of sustainability into the business model. It often aligns with long-term business resilience, drives innovation, and reduces exposure to climate-related risks in the supply chain.

Investors are increasingly prioritising companies that:

• Take measurable action to reduce Scope 1, 2, and 3 emissions

• Demonstrate a credible path to net-zero that doesn’t overly rely on offsets

• Show how sustainability investments enhance operational efficiency and supply chain security

• Provide transparency in ESG reporting, particularly around emissions reduction strategies

IR teams should be prepared to:

• Explain the company’s emissions strategy, differentiating clearly between insetting and offsetting

• Highlight insetting initiatives as evidence of embedded sustainability and long-term value creation

• Connect ESG progress to financial outcomes, such as cost savings, risk reduction, and reputational advantage

• Respond to investor questions with specific examples – not just carbon-neutral claims

Insetting isn’t just a sustainability play, it’s a signal of strong governance and operational maturity. In a market where ESG credibility drives capital flows, IR professionals must ensure that sustainability communications are both accurate and strategically aligned.

Conclusion

Carbon offsetting and insetting are two tools in the sustainability toolbox, but they’re not interchangeable. Offsetting can play a supporting role, especially in the short term, but insetting is where real change happens.

Whether you’re a sustainability leader, a business owner, or part of an investor relations team, it’s a great time to learn more about how you can play a part in shifting your strategies internally.